FACILITATING YOUR COLLECTION PROCESS

For every type of business, big or small, collecting payments from the products and services it sells to its customers is a vital element of its success.

Especially in the telecom industry, collecting payments from subscribers is not quite a straightforward process as many clients often fail to pay for all kinds of reasons.

This dilemma urges the adoption of a solid collection strategy reinforced by a dynamic, automated, and comprehensive collection management system.

At the core of ESKA Collections is ESKA® Dunning & Collection. It monitors debts based on payment arrangements. It is equipped with a wide array of features to help increase the effectiveness of your collection management processes.

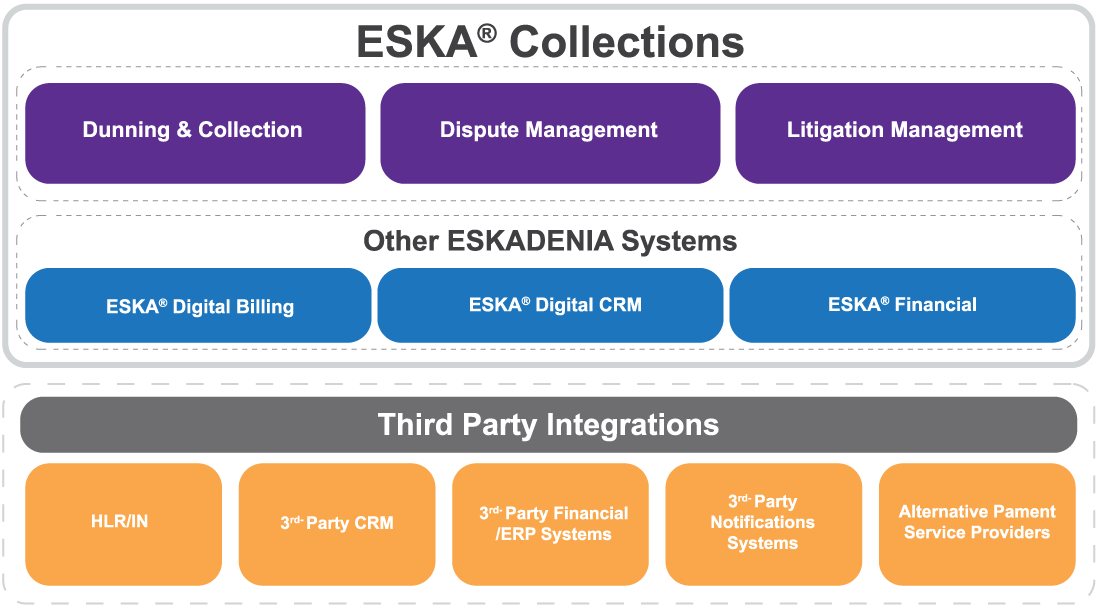

The other two systems in the ESKA Collections suite are ESKA® Dispute Manager, and ESKA® Legal.

ESKA® Collections is a comprehensive suite for managing all your debt collection processes. Its rich functionalities cover all three main stages of collection management:

- Collections & Dunning

- Dispute Management

- Matter Management

![SafeValue must use [property]=binding: Resources/2/Telecom-coll-5.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/Telecom-coll-5.jpg)

![SafeValue must use [property]=binding: Resources/2/Telecom-coll-6.jpg (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/Telecom-coll-6.jpg)

![SafeValue must use [property]=binding: Resources/2/Telecom-coll-7.png (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/Telecom-coll-7.png)

![SafeValue must use [property]=binding: Resources/2/Telecom-coll-8.png (see https://angular.dev/best-practices/security#preventing-cross-site-scripting-xss)](Resources/2/Telecom-coll-8.png)