26/11/2020

e-Banking trends are on the rise worldwide

By: Omar Abdulhafiz

In the past few decades, our perception of the things that are most essential to our daily lives has been transformed more than ever before. With the gradual and accelerating evolution of telecommunications technology, these gadgets have slowly become elementary parts of our lives as utilities such as water and electricity. Not having a phone at home, for example, may cause us to feel as if we are completely isolated from the outside world. And it does not stop here.

Fast forward to the second decade of the 21st century, even the ordinary phones are slowly becoming more like pieces of antiques, as these little powerful devices known as smartphones replace them. It never escapes us to liken their fate to that of typewriters as they were replaced with personal computers toward the last quarter of the 20th century.

In this article, we will focus on one particular aspect of the ubiquity of modern technology, which is electronic finance and banking. Before we delve further into the topic, however, perhaps we should take a moment to define e-Banking and have a quick look at its features.

What is e-Banking?

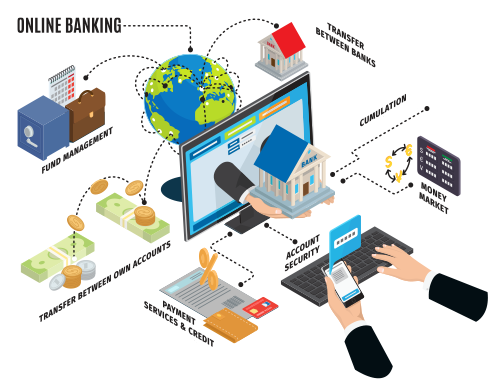

e-Banking is a general term for a number of technologies that aim to augment the banking experience beyond the boundaries of a bank’s physical branch. These technologies enable customers to carry out much of their day-to-day banking activities remotely, through the comfort of their PC’s and smartphones, without having to endure the hassles of visiting their bank’s physical branch, wait in line, and so on. Such activities include balance inquiries, paying their bills, money transfers, and much more.

|

| The e-Banking process |

What are some examples of e-Banking technology?

The most popular and widespread applications of e-Banking are Online Banking and Mobile Banking.

- Online Banking: These are mainly web portals specialized for handling banking activities through the computer.

- Mobile Banking: As their name suggests, these come in the form of mobile apps to be installed and used on smartphones.

In terms of functionality, there is usually no big difference between the two, and they both contribute to maximizing the general flexibility and convenience of the overall banking experience.

The spread of e-Banking

In their State of FinTech Report of 2017, PWC cited a study by Juniper Research that predicted mobile and contactless payments to achieve a global value of US$95bn by 2018. Interestingly enough, these figures are expected to increase exponentially in the next following years. According to a recent report by Allied Market Research, the Online Banking Market is forecasted to reach $31.81 Billion by 2027. A similar report by Valuates Reports (hosted on PR Newswire) also predicts Online Banking to reach 20.5 Billion USDs by 2026. The report detects a constant rise of the Online Banking customer base due to the growth of Internet penetration worldwide, as well as the spread of smartphone applications. Also, the report mentions speed, convenience for customers, and better interest rates offered by online banking as some of the main factors behind the increase of the Online Banking market size over the forecast period.

These big numbers indeed tell us a lot about the growing acclaim for online banking around the world. Moreover, this is especially true in light of the urgent need for social distancing imposed upon us by the COVID crisis nowadays.

To put this information in some context, let us next discuss the case of Europe. A recent Business Wire report estimates a significant growth rate of 15.2% CAGR between 2020 and 2026. According to the report, the driving factor behind this growth is that the Digital Banking Platform “enables the automated distribution of conventional and modern banking products and services directly to end-users via interactive channels of communication.” Additionally, the report states that more and more banks and financial institutions are investing in digital banking as a way to reach more clients around the globe and offer greater comfort for their current clients.

What does this mean for the banking sector as a whole?

Of course, the growth of online banking will have an impact on the banking and finance industry at large. For example, the same PWC FinTech report mentioned above estimated mobile and contactless payments to reduce the cost of providing basic financial services by 80-90%, thus leading to more financial inclusion. This can mean a couple things. For one thing, it means that gradually more and more people will cut their visits to the physical branches of their banks or keep them at a minimum, thus reducing the overall operational costs of running these branches. In addition, it may even reduce the need for banks to open more branches to begin with. A considerable amount of the money saved from the operational costs may then be re-allocated towards developing and improving banks’ digitalized services.

Furthermore, this could mean that the workforce needed to keep a bank’s operations up and running will be affected as well. The duties of a bank employee will like ‘transform’ from sifting through time-consuming paperwork toward being more of a moderator of digitalized banking operations, making sure they are going smoothly and securely. However, their role can shift to be facilitating these digital services or interacting online with customers rather than on the bank’s premises.

Overall, digital banking is making some big noise in the banking industry as it is helping banks and financial institutions get closer to their customers at much lower operating costs. That said, all indicators say that investment in digital banking solutions is on the rise, and we shall expect to see more financial institutions shift toward providing a digitally infused banking experience for their clients.

To learn more about online and mobile banking solutions from ESKADENIA, please visit our Online Banking and Mobile Banking product pages.